Beating the IRS for 40 Years! 833-445-2777

Beating the IRS for 40 Years! 833-445-2777

Larry Heinkel, Esq.

Tax Attorney since 1983

“I’m Tax Attorney Larry Heinkel. Did you know you’re likely eligible to receive up to $26,000 per employee through Employee Retention Credit (ERC) from the CARES Act?”

Business owners impacted by COVID-19 can claim up to $5,000 in refundable tax credits for each employee on their payroll in 2020 and up to a $7,000 credit per quarter for each employee in 2021.

ERC is Now Easier to Qualify For – Get Up to $26K Per Employee!

Hi, I’m Tax Attorney Larry Heinkel, and I hope you’re not missing out on benefits set aside for small- and medium-sized businesses to recover from COVID. You’ve most likely heard of the CARES Act, but most business owners don’t know exactly what’s in it – and most business owners have never heard of the Employee Retention Credit, or ERC.

ERC is real and it’s waiting for you to take advantage of it!

ERC is a quarterly tax credit against the employer’s share of certain payroll taxes. The tax credit is a flat $5,000 per employee in 2020 and 70% of the first $10,000 in wages per employee in three quarters in 2021. That means this credit is worth up to $7,000 per quarter and up to $26,000, for each employee.

I’m here to help you take advantage of what’s due to you, if you’re eligible. As a Tax Attorney for over 40 years, I know the tax codes – this is my expertise – and I want to put that expertise to good use for you and your business!

Find Out if Your Business is Eligible – And For How Much?

Call 833-445-2777 to Schedule Your FREE ERC Evaluation!

You may be eligible if your business:

• Has 500 or fewer employees;

• Was at least partly closed due to a government order OR the business’s revenue declined by 20% or more for any quarter

this year; AND

• You kept employees on the payroll:

Then you may be eligible for employee retention tax credits of up to $26,000 per employee. And the longer you have kept your employees on payroll, the more benefits you are eligible to receive.

For the 2021 tax year, the employee retention credit (ERC) is a quarterly tax credit against the employer’s share of certain payroll taxes. The tax credit is 70% of the first $10,000 in wages per employee in each quarter of 2021. That means this credit is worth up to $7,000 per quarter and up to $28,000 per year, for each employee. If the amount of the tax credit for an employer is more than the amount of the employer’s share of those payroll taxes owed for a given quarter, the excess is refunded – paid –directly to them.

Don’t get lost in the weeds! Yes, it’s the government, yes, it gets complicated – but that’s why our tax experts are here – to figure it all out for you! We’re here to help, and the best way to move forward is to schedule a FREE consultation with a member of our expert team!

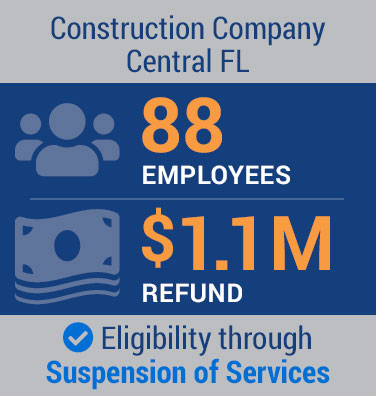

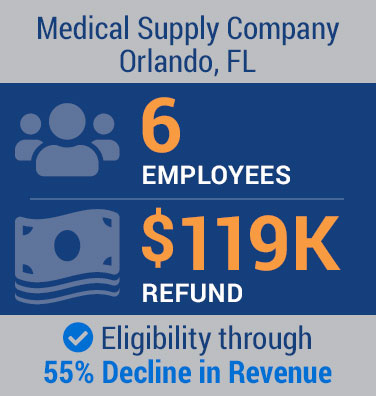

Here are some examples of businesses that have already taken advantage of this:

Many employers from a wide range of industries nationwide have benefited from our ERC services

Find Out if Your Business is Eligible – And For How Much?

Call 833-445-2777 to Schedule Your FREE ERC Evaluation!

What kind of businesses qualify for ERC?

An extremely broad range of businesses are good candidates for the ERC – any business who was impacted by COVID in any way, and managed to keep their employees on payroll qualify. (A few examples include restaurants, manufacturing, construction, food industry, healthcare – along with charities/tax exempts – churches, museums, food kitchens, schools – these are just the tip of the iceberg).

Most employers don’t realize that there are basically two simple ways you can qualify for the Employee Retention Credit:

1. Reduction in revenues; or

2. If your business/charity has had a more than nominal impact due to federal, state, local government or regulatory covid orders (easy examples, think of occupancy, spacing, cleaning requirements, just for starts)

If the answer to either question is YES, and the business had 500 or fewer employees, then any wages paid in the quarter may count towards the $10,000 per employee amount.

Businesses that received PPP loans in 2020 or 2021 can still claim the ERC. While wages used to apply for PPP loan forgiveness cannot also be claimed as ERC wages, remaining wages may be eligible for the credit.

My team of tax experts are the best means to find out if you qualify and to maximize the ERC benefits your business is entitled to!

You should act now because there is limited time to apply for benefits! Let us see if you qualify – and for how much!

Yet hundreds of thousands of businesses and charities across the country are failing to take advantage of the ERC. Billions of dollars are available for businesses and charities to retain employees and hire new employees. But you have to apply. Let our tax experts handle everything for you.

Don’t miss this window of opportunity.

Call 833-445-2777 NOW to find out if your

business qualifies and for how much. You could be

eligible for 5, 6, even 7 figures. We recently got a

client $1.1 million dollars. NO UPFRONT FEES.

It’s 100% Contingency.