In a report to the Secretary of the Treasury, the Internal Revenue Service laid out its strategic operating plan for the next decade, with details on how it plans to use the extra IRS funding. $80 billion was recently given to improve customer service, beef up its ability to examine large corporate and high-income individual taxpayers, and update its antiquated systems and technology.

Service and technology enhancements with an eye on the future

"The plan is a bold look at what the future can look like for taxpayers and the IRS," recently installed IRS Commissioner Danny Werfel said, in a statement. "Now that we have long-term funding, the IRS has an opportunity to transform its operations and provide the service people deserve. Through both service and technology enhancements, the experience of the future will look and feel much different from the IRS of today."

The IRS has been working on the 150-page Strategic Operating Plan in the aftermath of last August's passage of the Inflation Reduction Act, which included $80 billion in new funding for the agency over 10 years.

One clear goal of the plan is to allay concerns that had arisen about how that money will be spent. For instance, the original news of the extra funding raised fears that the IRS would begin targeting middle-class taxpayers and small businesses, leading Republicans in Congress to propose taking the money back.

The IRS said there are three key areas where the money will be deployed:

- To "rebuild and strengthen" customer service activities, which suffered enormously over the course of the pandemic, leading to infamously long wait times on IRS phone lines, for instance;

- To build the agency's capacity to audit high-income taxpayers — which the IRS specified are the roughly 30,000 people earning more than $10 million a year — and complex large businesses; and,

- To update the agency's many outdated technology systems.

The plan includes 42 "key initiatives" and 190 "key projects" that the service will undertake over the next decade, with the understanding that it will add projects as necessary.

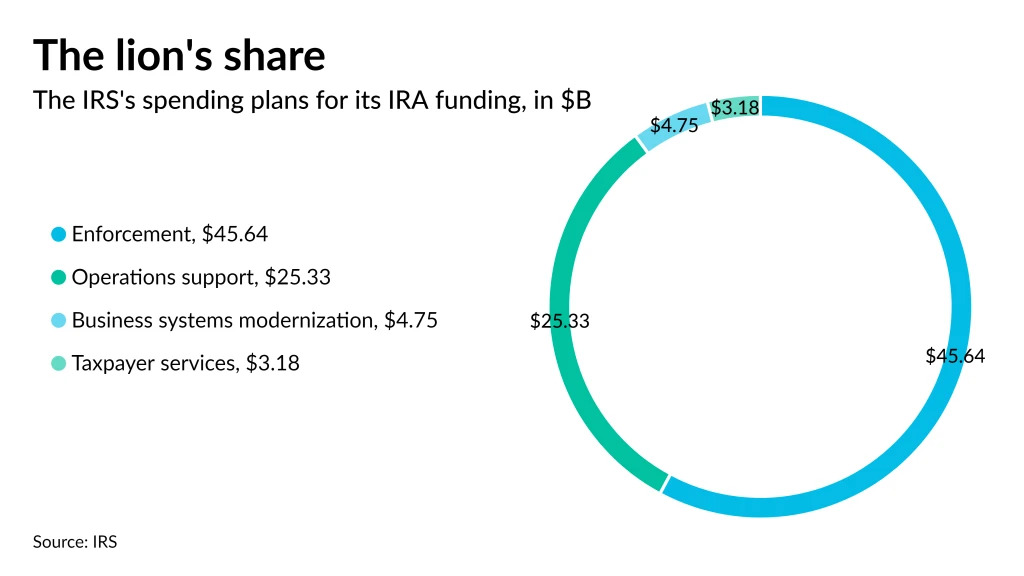

While the document does discuss hiring almost 30,000 new employees — including 5,000 customer service representatives — it does not specify how many of them will work in enforcement. Given that $45 billion of the total $80 billion is slated for enforcement, it seems likely that many of those new hires will be in that area.

At the same time, much of the hiring will simply make up for ongoing attrition, and the long-term decline in funding and staffing levels: The IRS currently has approximately 80,000 employees, which is roughly 19% less than the 95,000 it had in 2010.

Real improvements for taxpayers

"For years, the agency has not had the resources to provide the service people deserve. Across all of our operations we've seen the impact," Werfel said. "We've lost employees and seen our resources stretched thin with new mandates and an increasingly complex economy. The IRS looks forward to demonstrating how the actions under this plan will translate into real improvements for taxpayers. Technology as well as in-person assistance will be cornerstones of this effort."

The commissioner claimed that the impact of the funding is already being felt: "People can see the first signs of change this filing season following this infusion of funding," he said. "Taxpayers and tax professionals can see the difference as we have dramatically improved our phone service thanks to more staff. More walk-in services are available across the country. New digital tools have been added. And these are just first steps."

Increased IRS funding will likely put you in their crosshairs...

As we see this extra IRS funding change the landscape at the IRS, if you get a notice of audit from the IRS – or find yourself on their radar in any way – don't ignore it! Contact me or any member of my Tax Problem Solver team for help, and we'll start the ball rolling to solve whatever is going on.

You can reach us by one of the contact methods below in the blue box, or email me at Larry@TaxProblemSolver.com and we can review your specific issues and solve them. You can also click here to book a free consultation.

Would You Like to Find Out What Your

Next Best Steps Should Be?

Choose one of the 3 FREE contact methods that is easiest for you.

Click the calendar button below to view our appointment calendar, and choose a day & time, and we’ll call you then.

We look forward to your free consult!

Click the phone button below to either "click to call" or direct dial a number to speak with us right now.

We look forward to speaking with you!

9-Secrets You Need to Know

When the IRS is after you, you need to be informed. What you say to the IRS can be used against you.

Get My 9 Secrets email series now. I'll also add you to my newsletter.